Greenville-Spartanburg has quietly become one of the Southeast’s most compelling industrial markets. With over $8 billion in manufacturing investments announced in 2024 alone1 and the second-highest concentration of manufacturing jobs in the region,2 this South Carolina corridor is writing the next chapter of American industrial growth.

The numbers tell a story of momentum that extends throughout Upstate South Carolina industrial development. The region recorded its highest absorption in multiple years during Q4 2024, driven entirely by automotive original equipment manufacturers seeking space3. Meanwhile, the recent completion of a $55 million Inland Port expansion that doubled cargo capacity4 signals anticipated surge in distribution activity that could reshape the logistics landscape across the Southeast.

Why Greenville’s Strategic Location Drives Industrial Growth

Geography is destiny in industrial real estate, and Greenville-Spartanburg holds a winning hand. The region sits at the intersection of I-85, I-385, I-26, and I-185 – creating what industry experts call a “golden quadrant” for manufacturing and distribution operations.

This strategic positioning has made Greenville a transloading hub that rivals major metropolitan markets. Companies can move goods efficiently by air through Greenville-Spartanburg International Airport (GSP), by rail through the SC Inland Port, or by truck along the interstate network that connects the region to major population centers from Atlanta to Charlotte.

Beyond logistics, the region offers attractive business incentives. Tax incentives for job creation and other economic development partnerships help offset startup costs for new manufacturers, making the total cost of operation even more competitive. The region’s workforce development infrastructure further enhances these competitive advantages. Clemson University International Center for Automotive Research (CU-ICAR) produces engineers specifically prepared to support the automotive industry, creating a direct pipeline from education to employment that benefits both OEMs and suppliers.

The logistics advantages aren’t theoretical. FreightBox Pro recently highlighted how Greenville’s multimodal infrastructure has attracted e-commerce and supply chain operations looking to optimize their Southeast distribution strategies5. For manufacturers, this means shorter supply chains and faster time-to-market – competitive advantages that translate directly to their bottom line.

Automotive Manufacturing Leads the Charge

The automotive sector is driving much of Greenville’s current expansion. BMW’s Spartanburg plant, which generates a $26.7 billion annual economic impact according to a comprehensive study6,has created a supplier ecosystem that continues to attract new investment.

The recent announcement of Isuzu’s new assembly plant in Greenville County signals the next wave of growth. Combined with the new Scout plant in Columbia, SC, industry observers expect these developments to trigger an influx of automotive tier 1 and tier 2 suppliers, creating a ripple effect throughout the industrial market.

This automotive clustering isn’t accidental. The region’s manufacturing workforce, developed over decades, provides the skilled labor these operations require. Clemson University International Center for Automotive Research (CU-ICAR) and Center for Supply Chain Management work directly with OEMs and Tier 1 manufacturers, producing engineers and industry leaders who can transition immediately into local operations. This partnership between academia and industry ensures a continuous pipeline of talent specifically trained to support the region’s automotive expansion.

But automotive is just one piece of the puzzle. Aerospace manufacturing, advanced materials, chemical production, food and beverage processing, and firearm manufacturing all have significant presences in the region. Data centers have emerged as another major growth sector, with $4.1 billion in investments announced in 2024 alone from companies like Google and Meta7.

Market Dynamics and Development Trends

The industrial real estate market is experiencing a notable shift. According to Avison Young’s recent analysis8, developers are building smaller facilities – typically between 80,000 and 250,000 square feet for manufacturing, and 250,000 and 350,000 square feet for distribution.

This trend reflects changing tenant preferences and market realities. With a current vacancy rate of 10.2%9, developers have moved away from speculative building toward build-to-suit projects that meet specific tenant requirements. This approach reduces risk while ensuring facilities are designed for their intended use from day one.

CBRE’s Q1 2025 market report9 shows over 1 million square feet of direct net absorption in early 2025, indicating strong demand despite the higher vacancy rates. The market has stabilized after a significant construction boom, creating opportunities for companies that understand the current dynamics.

Challenges Create Opportunities

The current oversupply of industrial space, while challenging for speculative developers, creates opportunities for end users and build-to-suit projects. Companies can secure prime locations along interstate corridors at competitive rates, particularly for larger facilities that might have faced premium pricing in tighter markets.

For developers willing to adapt, the market rewards those who understand tenant needs and can deliver specialized facilities. Cold storage, advanced manufacturing capabilities, and distribution centers designed for e-commerce fulfillment are seeing particularly strong demand.

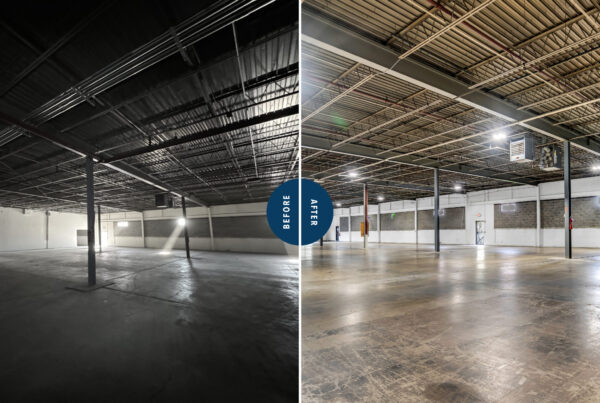

The key is moving beyond traditional warehouse development to facilities that support modern manufacturing and distribution requirements. This might mean higher ceiling heights for automated systems, enhanced power infrastructure for advanced manufacturing, or specialized environmental controls for pharmaceutical or food processing operations. In today’s market, manufacturers need partners who can navigate these complexities while maintaining aggressive timelines.

Looking Ahead: The Next Decade

Several factors position Greenville-Spartanburg for continued growth over the next five to ten years. The automotive sector expansion, driven by new assembly plants and suppliers relocating from Mexico and Canada to avoid tariffs, represents just the beginning. In 2024 alone, the automotive sector announced $1.3 billion in new investments across the region10.

Distribution will see steady growth as e-commerce continues expanding and companies seek to position inventory closer to Southeast population centers. This region’s logistics infrastructure can support this growth without the congestion challenges facing larger metropolitan markets.

Technology adoption will reshape facility requirements. BMW is already implementing robotics in its current operations, and other manufacturers are following suit. This automation trend will influence future facility design, requiring high power loads, more sophisticated HVAC systems, and layouts optimized for human-robot collaboration.

Sustainability considerations are also becoming more important. Companies are seeking facilities that support their environmental goals, whether through energy-efficient design, renewable energy integration, or sustainable building materials.

The Power of Partnership in Industrial Development

The Greenville market rewards companies that understand local business culture and can deliver results quickly. The region’s relationship-first approach means that once manufacturers see a partner’s capabilities and integrity, long-term business relationships often follow.

This environment particularly suits integrated design-build approaches that can accelerate project timelines. When automotive suppliers or distribution companies need to be operational quickly to capture market opportunities, traditional design-bid-build processes become a liability. Manufacturers want to start production as quickly as possible to fill orders, making speed-to-market a competitive advantage for both tenants and their development partners.

ARCO Design/Build brings national best practices refined through projects across multiple markets, then adapts these proven methodologies to meet the specific requirements and business culture of the Greenville-Spartanburg region. This combination of national reach and local expertise proves particularly valuable in a market where relationships and results matter equally.

The complexity of modern industrial facilities – from automated manufacturing lines to temperature-controlled distribution centers – requires early collaboration between design and construction teams. Issues that might derail a project late in traditional delivery methods can be identified and solved during design when the design-build team works as true partners.

Established design-build firms in the region also leverage deep relationships with local subcontractors and specialty trades who understand the unique requirements of industrial construction. These regional partnerships become particularly valuable when projects require specialized systems or accelerated schedules, ensuring quality work gets completed by teams familiar with local conditions and building practices.

The most successful industrial developers in Greenville combine national-scale resources and experience with deep local market knowledge. This dual capability allows them to bring proven solutions from other markets while understanding the nuances of Upstate South Carolina’s business environment, regulatory landscape, and workforce characteristics.

Success in this market isn’t just about delivering projects on time and on budget, though that’s the foundation. It’s about understanding how a facility will actually operate and designing solutions that support operational efficiency from day one. In a market where word-of-mouth referrals carry significant weight, this partnership approach creates lasting competitive advantages.

Conclusion

Greenville-Spartanburg’s industrial growth story combines strategic advantages with market momentum. The region’s location, workforce, and business environment have created conditions for sustained expansion across multiple industrial sectors.

The current market dynamics – higher vacancy rates, shifting toward build-to-suit projects, and growing demand for specialized facilities – create opportunities for companies that understand the landscape. Success requires adapting to changing tenant needs while leveraging the region’s fundamental strengths.

As automotive manufacturing expands, distribution operations grow, and technology reshapes facility requirements, Greenville-Spartanburg is positioned to capitalize on these trends. The industrial boom isn’t just about current growth – it’s about building the foundation for the next chapter of American manufacturing and distribution.

For companies considering Southeast expansion, Greenville offers something increasingly rare: room to grow in a market with proven industrial expertise and infrastructure to support it.

Ready to explore opportunities in Greenville-Spartanburg’s dynamic industrial market? Whether you’re planning a new manufacturing facility, distribution center, or expansion project, the right development partner can make the difference between a good project and a great one. ARCO Design/Build combines national expertise with deep local relationships to deliver industrial facilities that support operational success from day one.

Contact ARCO/Design Build to discuss how our integrated approach can accelerate your Greenville-Spartanburg project timeline and ensure your facility meets both current needs and future growth plans. In a market where speed-to-market and local relationships drive success, experience matters. For companies exploring industrial development opportunities in the Greenville-Spartanburg market, the combination of strategic location, skilled workforce, and collaborative business environment creates conditions for long-term success.

References

- South Carolina Department of Commerce. “South Carolina industry recruitment reaches $8.19 billion in 2024.” January 6, 2025. https://www.sccommerce.com/news/south-carolina-industry-recruitment-reaches-819-billion-2024

- Bureau of Labor Statistics, Southeast Regional Manufacturing Employment Data (Note: Based on regional economic development agency reporting; specific ranking data sourced from Upstate economic development authorities)

- CBRE. “Greenville-Spartanburg Industrial Figures Q1 2025.” https://www.cbre.com/insights/figures/greenville-spartanburg-industrial-figures-q1-2025

- South Carolina Ports Authority. “SC Ports announces completion of $55 million expansion of Inland Port Greer.” March 26, 2025. https://www.foxcarolina.com/2025/03/26/sc-ports-announces-completion-55-million-expansion-inland-port-greer/

- FreightBox Pro. “Why Greenville Is Becoming a Transloading Hub in the Southeast.” https://freightbox.pro/blog/why-greenville-is-becoming-a-transloading-hub-in-the-southeast

- BMW Group Plant Spartanburg Economic Impact Study. https://www.bmwgroup-werke.com/content/dam/grpw/websites/bmwgroup-werke_com/spartanburg/news/2023/BMWImpactStudy_withBMWadditions.pdf

- South Carolina Department of Commerce. “South Carolina industry recruitment reaches $8.19 billion in 2024.” January 6, 2025. https://www.sccommerce.com/news/south-carolina-industry-recruitment-reaches-819-billion-2024

- Avison Young. “Industrial buildings in Greenville-Spartanburg are getting smaller.” https://www.avisonyoung.us/w/industrial-buildings-in-greenville-spartanburg-are-getting-smaller

- CBRE. “Greenville-Spartanburg Industrial Figures Q1 2025.” https://www.cbre.com/insights/figures/greenville-spartanburg-industrial-figures-q1-2025

- South Carolina Department of Commerce. “South Carolina industry recruitment reaches $8.19 billion in 2024.” January 6, 2025. https://www.sccommerce.com/news/south-carolina-industry-recruitment-reaches-819-billion-2024