In established industrial markets across the United States, where vacancy rates are steadily climbing and available land is increasingly scarce, property owners face a critical challenge: How can existing commercial spaces be reimagined to meet modern business needs? At ARCO Design/Build, our Capital Improvements division specializes in strategic improvements – including white boxing – that transform underperforming industrial assets into highly marketable spaces.

This guide explores how our integrated design-build approach to white boxing creates opportunities for property owners nationwide, providing a framework to evaluate this strategic improvement option for your specific situation.

Understanding White Boxing in Our Capital Improvements Spectrum

White boxing – a cost-effective approach to preparing commercial spaces for new tenants – is gaining traction nationwide as property owners seek faster occupancy timelines and flexible solutions to meet evolving tenant demands.

As part of our comprehensive improvement services, white boxing typically includes:

- Cosmetic Improvements: Fresh paint, updated flooring, and aesthetic enhancements

- Essential Systems Upgrades: Modernizing HVAC, electrical, and plumbing systems

- Functional Enhancements: Renovating bathrooms, upgrading dock equipment, and ensuring ADA compliance

- Spec Office Components: Creating flexible, move-in-ready office areas within industrial spaces

- Code Compliance: Addressing regulatory requirements while balancing cost considerations

White boxing sits on a spectrum of our Capital Improvements offerings:

| Service Type | Scope | Best For |

| White Boxing | Cosmetic and functional improvements without structural changes | Properties needing market repositioning while maintaining flexibility |

| System Modernization | Focused upgrades to building systems (HVAC, electrical, etc.) | Facilities with functional layouts but outdated infrastructure |

| Tenant Improvements | Customized modifications for specific tenant needs | Spaces with committed tenants requiring specialized features |

| Retrofitting | Substantial modifications including potential structural changes | Buildings requiring significant upgrades to meet modern standards |

| Adaptive Reuse | Comprehensive transformation of a building’s purpose | Properties being converted to entirely new uses |

Unlike ground-up construction or comprehensive retrofitting (which might involve structural changes like lifting roofs or reinforcing foundations), white boxing focuses on practical improvements that preserve flexibility for diverse tenant needs.

Why White Boxing Makes Sense in Today’s Industrial Market

Recent market data reveals why our Capital Improvements approach – particularly white boxing – is especially relevant in today’s industrial landscape:

1. Rising Vacancy Rates Creating Repositioning Opportunities

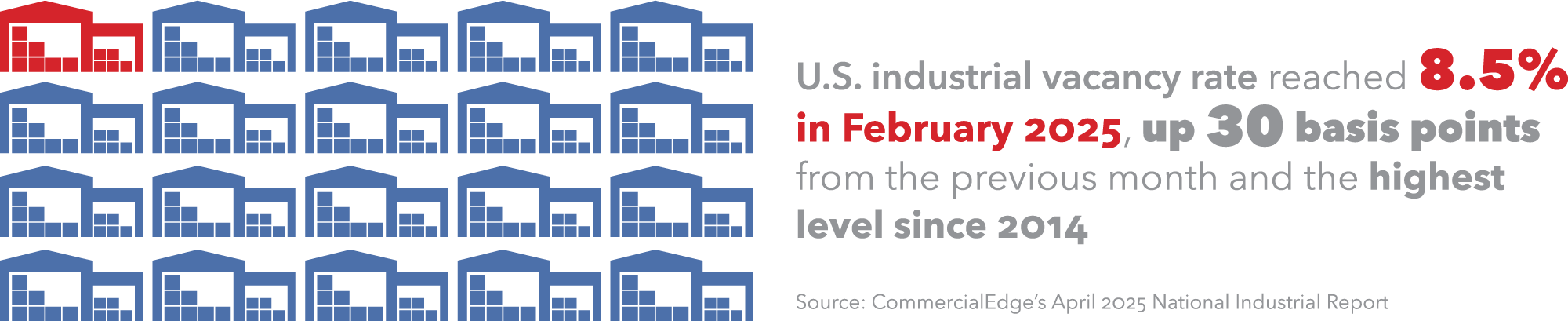

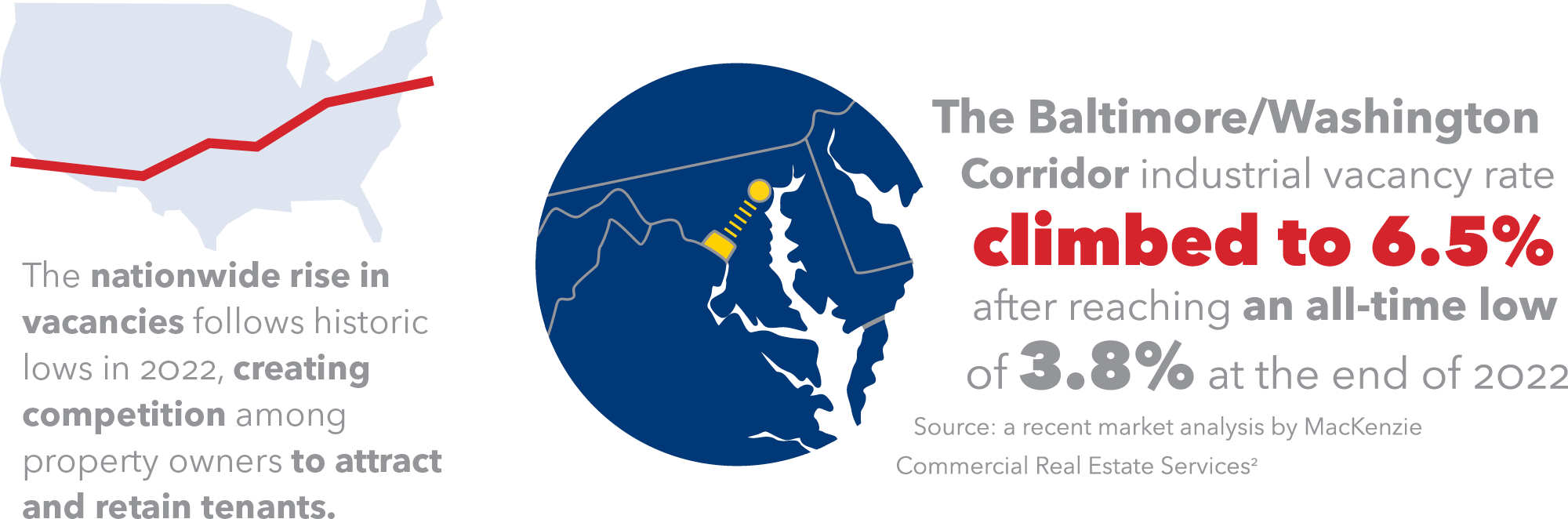

According to CommercialEdge’s April 2025 National Industrial Report, the U.S. industrial vacancy rate reached 8.5% in February 2025, up 30 basis points from the previous month and the highest level since 2014. This nationwide trend follows historic lows in 2022, creating competition among property owners to attract and retain tenants. In urban markets with limited land availability, such as Baltimore, Washington, DC, Philadelphia, New York, and Houston, strategic improvements can differentiate properties in this evolving landscape.

For example, in the Baltimore/Washington Corridor, the industrial vacancy rate climbed to 6.5% after reaching an all-time low of 3.8% at the end of 2022, according to a recent market analysis by MacKenzie Commercial Real Estate Services. This shift mirrors the national trend of increasing vacancies, highlighting the growing importance of strategic property improvements.

2. Aging Building Stock Requiring Modernization

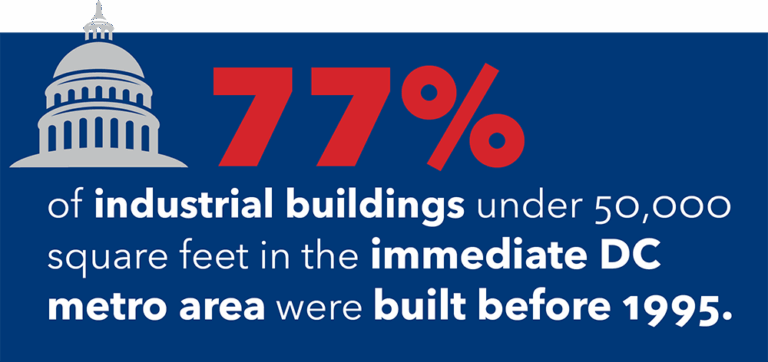

Market analysis from Newmark’s Q1 2025 Baltimore Industrial Market Report shows that many industrial buildings, particularly those under 50,000 square feet, were constructed decades ago and no longer meet modern operational requirements.These properties typically have lower clear heights (16 to 18 feet), smaller truck courts, and outdated office configurations – perfect candidates for our white boxing expertise.

As an illustration, 77% of industrial buildings under 50,000 square feet in the immediate DC metro area were built before 1995. This pattern repeats in established industrial corridors nationwide, where aging buildings present both challenges and opportunities for strategic improvement.

3. Strong Demand for Updated Small-to-Mid-Size Spaces

Despite rising overall vacancy rates, buildings under 50,000 square feet maintain stronger performance in many markets. In the DC area, for instance, these smaller facilities maintain a tight 3.8% vacancy rate with rents trending upward to over $16 per square foot. Similarly, according to NAIOP Maryland’s “2025 CRE Stories to Watch,” flex space in Maryland is about 95% occupied, showing continued strong demand for flexible, smaller industrial spaces.

This trend is consistent across major urban markets where our Design-Build Managers (DBMs) have identified prime opportunities for strategic white boxing investments.

4. Shift in Supply Chain Strategies

We’re observing a market shift from the pandemic-inspired “just-in-case” inventory model back to “just-in-time” approaches. This transition has implications for how industrial spaces need to function, creating opportunities for strategically improved properties that support efficient operations.

5. Limited New Development Pipeline

JLL’s Q1 2025 Industrial Market Dynamics report indicates the development pipeline has contracted to its lowest point since 2015, shrinking nearly 30% year-over-year to 253.2 million square feet. Only 236 million square feet of new construction commenced in 2024, signaling a continued slowdown.

In established urban markets, development has been particularly constrained by zoning/land limitations, increased costs, and extended municipal approval processes. These constraints make improving existing assets an increasingly attractive alternative to new construction, a specialty of our Capital Improvements division.

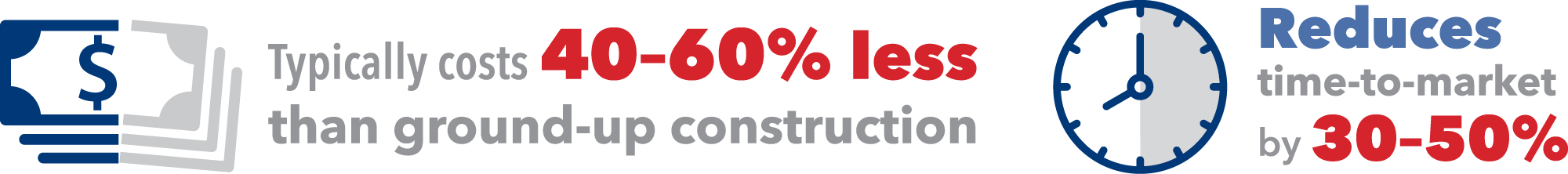

White boxing typically costs 40-60% less than ground-up construction while reducing time-to-market by 30-50%, enabling faster leasing and revenue generation. This approach also aligns with sustainability goals by reusing existing structures and reducing construction waste.

How Our Design-Build Approach Enhances White Boxing Outcomes

At ARCO Design/Build, we bring a unique integrated approach to white boxing projects that deliver superior results compared to traditional improvement methods:

1. Single-Source Accountability Through Design-Build Management

Our DBMs lead integrated design and construction teams, serving as your single point of contact throughout the project. With deep industrial expertise and market knowledge, DBMs align improvements with both immediate needs and long-term property value, eliminating communication gaps and reducing costly revisions.

2. Specialized Industrial Expertise

Our team’s specialized knowledge of industrial facility requirements enables us to anticipate challenges and implement solutions that maximize functionality and marketability across diverse sectors. This expertise translates into creative solutions that keep projects moving forward despite the complexities of existing buildings.

3. Operational Continuity Focus

For properties with existing tenants, our teams develop phased improvement strategies that minimize disruption. Our proprietary planning methodologies maintain critical operations during improvement projects, protecting revenue streams throughout the process.

4. Value Engineering Capabilities

Our integrated approach enables real-time value engineering throughout the white boxing process. By constantly evaluating design decisions against cost implications, we maximize the impact of improvement investments while controlling overall project expenses and preserving flexibility for future tenants.

This integrated leadership approach eliminates the coordination challenges typical in improvement projects while ensuring decisions balance immediate market demands with long-term property value.

Evaluating Your Property’s White Boxing Potential

Not every property is an ideal candidate for white boxing. Our Capital Improvements team conducts comprehensive assessments based on these key factors:

Building Fundamentals

- Structure Integrity: Is the building structurally sound with minimal deferred maintenance?

- Location Value: Does the property sit in an established industrial corridor?

- Configuration Adaptability: Can the layout accommodate modern operational flows?

- Clear Height Potential: Buildings with at least 24’ clear heights appeal to broader tenant bases

- Column Spacing: Wider spacing offers flexibility for diverse industrial uses

Market Alignment

- Target Tenant Profile: What type of industrial user would find the property most suitable?

- Competitive Landscape: How does your property compare to others nearby?

- Rent Expectations: Will post-improvement rents justify the investment?

Improvement Scope Considerations

- Code Trigger Thresholds: Which upgrades might require broader compliance changes?

- Essential vs. Optional Upgrades: What’s necessary versus what adds value?

- Tenant Flexibility and Balance: How specialized should improvements be?

How We Overcome Common White Boxing Challenges

Our Capital Improvements division has developed specialized approaches to address the unique challenges of white boxing projects:

Challenge: Limited Information on Existing Structures

When working with older buildings, documentation is often incomplete or outdated, making design and pricing difficult.

Our Solution:

- Conduct thorough initial assessments with integrated design-construction teams

- Document known information while identifying specific knowledge gaps

- Develop flexible designs accommodating reasonable variations

- Plan for progressive discovery during early construction phases

- Maintain appropriate contingency budgets proportional to uncertainty levels

Challenge: Code Compliance Complexity

Navigating modern building codes with existing structures requires careful planning and expertise.

Our Solution

- Engage with local code officials early to understand specific interpretations

- Identify thresholds triggering broader compliance requirements

- Structure scope to address critical safety concerns while managing compliance triggers

- Consider phased approaches for gradual improvements without triggering comprehensive requirements

- Document existing non-conforming conditions that may be grandfathered

Challenge: Balancing Improvements with Future Flexibility

Each property owner has unique objectives – from maximizing short-term rental income to positioning for long-term value appreciation or preparing for specific tenant types.

Our Solution:

- Begin by understanding your specific investment objectives, timeline, and target tenant profile

- Identifying which improvements deliver the highest ROI for your particular situation

- Present options ranging from universal enhancements to targeted improvements

- Design infrastructure with future adaptability in mind (e.g., electrical services with expansion capacity)

- Maintain comprehensive documentation to facilitate future modifications as market demands evolve

Challenge: Accurate Cost Estimation with Unknowns

Developing reliable budgets for existing buildings presents unique challenges compared to new construction.

Our Solution:

- Create tiered estimates with clearly identified assumptions

- Separate known costs from provisional allowances

- Establish early warning systems for potential budget impacts

- Implement progressive estimation refinement as information improves

- Structure contracts to accommodate discovery and adjustment

White Boxing and Sustainability: Meeting ESG Goals

White boxing naturally aligns with environmental, social, and governance (ESG) objectives:

- Environmental Benefits: Reduces construction waste by reusing existing structures

- Energy Efficiency: Opportunities to upgrade systems to modern efficiency standards

- Material Selection: Options for low-VOC finishes and sustainable materials

- Community Impact: Revitalizes existing properties rather than developing new land

- Cost-Effective Compliance: Phased approach to meet energy code requirements

Our team can help you identify which sustainability improvements offer the best combination of environmental benefits, tenant appeal, and return on investment.

The ARCO Capital Improvements Advantage for Different Stakeholders

For Property Owners and Developers

We understand your need to maximize asset value while controlling costs. Our white boxing approach optimizes your capital expenditures by focusing on improvements that enhance marketability without overcommitting to specific tenant requirements. Our DBMs work directly with you to develop improvement strategies aligned with your investment objectives and holding timeline.

For Property Managers

We minimize the headaches typically associated with improvement projects. Our teams coordinate closely with property management to address tenant concerns, maintain building systems during improvements, and provide comprehensive documentation for future reference. Our phased implementation approaches respect the operational needs of existing tenants.

For End Users

For owner-occupiers considering white boxing their own facilities, we design improvements that enhance both aesthetics and functionality. Our DBMs help you prioritize upgrades that support your specific operational requirements while maximizing the long-term value of your property.

Making an Informed Decision with ARCO’s Capital Improvements Team

When considering white boxing for your industrial property, our Capital Improvements division implements a proven four-step process:

- Comprehensive Assessment

- Thorough evaluations of building fundamentals and market alignment

- Analysis of current market demands, competitive positioning, and regulatory constraints

- Identification of specific opportunities to enhance property value

- Strategic Improvement Planning

- Customized improvement strategies aligned with your objectives

- Consideration of target tenant profiles, rental rate goals, and investment return expectations

- Phased implementation options that optimize both cost and disruption management

- Value-Engineered Design Development

- Improvement plans focused on maximizing ROI

- Balance of essential building improvements with market-responsive enhancements

- Flexibility to accommodate potential tenant-specific customizations

- Efficient Project Execution

- Implementation with minimal disruption

- Transparent communication throughout the process

- Comprehensive documentation and support for future property management

Strategic Code Compliance Management

One of the most valuable aspects of our Capital Improvements approach is our expertise in navigating code compliance requirements. Our DBMs understand how to structure white boxing scope to address critical needs while avoiding unnecessary triggers for broader compliance requirements. Key considerations include:

- Improvement Value Thresholds: Structuring projects to work within percentage-based triggers (e.g., improvements exceeding 50% of building value)

- Change of Use Considerations: Advising on potential implications of converting spaces between different use types

- Fire and Life Safety Priorities: Focusing on safety-related upgrades that are typically prioritized by code officials

- ADA Compliance: Implementing accessibility improvements following “path of travel” approaches with specific spending thresholds

- Energy Code Requirements: Guiding decisions around energy-related upgrades that may trigger broader efficiency improvements

Looking Ahead: Understanding Your Capital Improvements Options

Contact Our Capital Improvements Team Today

White boxing represents a strategic approach for industrial property owners nationwide to maximize asset value in a changing market environment. By addressing cosmetic and functional upgrades through our integrated design-build approach, we help clients enhance property marketability while controlling costs and implementation timelines.

Contact our team today to schedule a property assessment or learn more about how white boxing can maximize your investment. Our Capital Improvement specialists can provide a complimentary evaluation of your property’s potential and develop a tailored improvement strategy aligned with your specific objectives.

This educational guide is part of our ongoing commitment to providing balanced, informative content to help industrial property stakeholders make informed decisions about capital improvements.